How Are Neobanks Changing the Way Americans Bank?

Published on March 22, 2025 by Your Name

Banking in America used to mean brick-and-mortar branches, long lines, and sneaky fees. Enter neobanks—digital-only banks that are shaking things up. If you’re asking, “How are neobanks changing the way Americans bank?”—you’re tapping into a fintech revolution. Here at MakeCashOnline.io, we’re diving into this trend under our “Fintech Evolution” subcategory to show you what’s driving this shift and what it means for your wallet.

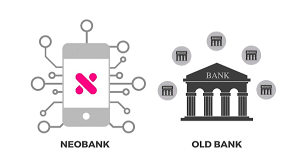

What Are Neobanks, Exactly?

Neobanks are online-only financial institutions with no physical branches. Think Chime, Varo, or SoFi—names you’ve probably seen popping up on your phone. They operate through slick apps, offering checking accounts, savings, and even loans, all without the overhead of traditional banks. In the U.S., they’ve exploded in popularity, with millions of Americans ditching big banks for these digital alternatives.

How Neobanks Are Transforming Banking

1. Low Fees, High Appeal

One word: fees. Traditional banks love them—monthly maintenance, ATM charges, overdraft penalties. Neobanks? Not so much. Most offer free accounts and no hidden costs, a huge draw for Americans tired of getting nickel-and-dimed. Chime, for instance, boasts no overdraft fees up to $200, saving users real cash.

2. Mobile-First Convenience

Who has time to visit a bank? Neobanks put everything—deposits, transfers, budgeting—at your fingertips via mobile apps. In a country where 85% of adults own smartphones, this convenience is a game-changer. Need to check your balance at 2 a.m.? No problem. It’s banking on your terms.

3. Innovative Tools for Smarter Money Moves

Neobanks aren’t just basic accounts—they’re packed with features. Think automatic savings roundups, real-time spending alerts, or even early paycheck access. SoFi’s app, for example, blends banking with investing, appealing to Americans who want more control over their finances without the hassle.

The Impact on American Banking

Neobanks are forcing everyone to step up. Big banks like Wells Fargo and Bank of America are scrambling to cut fees and beef up their apps to compete. Meanwhile, neobanks are growing fast—Chime alone has over 15 million users and counting. Posts on X highlight how younger Americans, especially Gen Z and Millennials, are driving this shift, craving flexibility over tradition.

They’re also shaking up the fintech landscape. By focusing on customer experience, neobanks are setting a new standard—less about marble lobbies, more about what’s in it for you.

The Catch: What’s Not Perfect?

Neobanks aren’t flawless. No branches mean no in-person help, which some folks still want. Cash deposits can be tricky—often requiring third-party retailers like Walgreens. And while they’re FDIC-insured through partnerships, some worry about their long-term stability compared to legacy banks. It’s a trade-off worth weighing.

Why This Matters to You

For the average American, neobanks mean more options and less waste. They’re perfect if you’re looking to save on fees, manage money on the go, or explore fintech’s cutting edge. At MakeCashOnline.io, we see this as a chance to stretch your dollars further—whether you’re banking, investing, or just keeping tabs.

Curious about fintech trends? Check out this rundown from Forbes for more on where banking’s headed.

Looking Ahead

Neobanks aren’t slowing down. Analysts predict they’ll keep grabbing market share, pushing traditional banks to adapt or fade. For Americans, it’s a win—more competition, better services, and a fresh take on managing money. Stick with us to see how this fintech evolution unfolds!

What’s your take on neobanks? Tried one yet? Let us know in the comments!

Related Posts:

Leave a comment

Your email address will not be published. Required fields are marked *